Nokia, with its Q3 results, has beaten market expectations. For example analysts predicted a figure of €0.10 EPS, against a reported figure of €0.14 EPS. Margins in the crucial Devices and Services division were also ahead of expectations and consequently Nokia's share price is trading 7% up.

Stephen Elop, Nokia CEO, said:

"In the five weeks since joining Nokia, I have found a company with many great strengths and a history of achievement that is second to none in the industry. And yet our company faces a remarkably disruptive time in the industry, with recent results demonstrating that we must reassess our role in and our approach to this industry.

Some of our most recent product launches illustrate that we have the talent, the capacity to innovate, and the resources necessary to lead through this period of disruption. We will make both the strategic and operational improvements necessary to ensure that we continue to delight our customers and deliver superior financial results to our shareholders."

Looking forward Nokia now expects its market share for 2010 to be slightly down on 2009, but still a healthy 'high thirties' percent. Previously Nokia indicated that its market share would be flat. Nokia is expecting its Devices and Services margin to be between 10% and 12% in Q4 with sales between €8.2 billion and €8.7 billion, somewhat ahead of previous predictions.

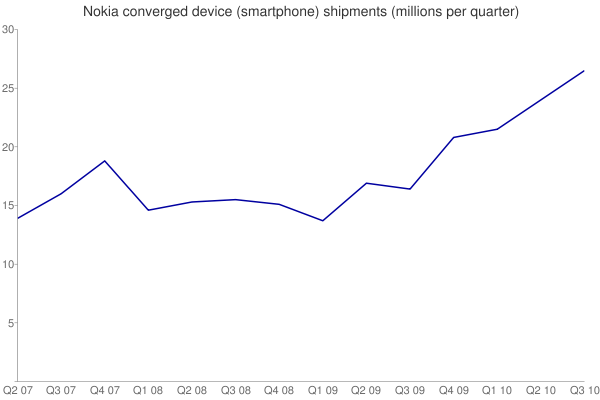

Nokia's Q3 results come in advance of the expected positive impact of its new line of Symbian^3 handsets. The strength of sales in converged devices was primarily based on lower cost devices such as the Nokia 5230 and its variants, with sales of Eseries device remaining an important contributory factor.

Points of interest

- Nokia mobile device volumes were 110.4 million units, up 2% year on year and down 1% sequentially. This is set against estimated industry volumes of of 364 million units, up 14% year on year and up 8% sequentially. Nokia's overall (phones) market share was 30%, down 4% from Q2 2009 and down 3% from Q2 2010 (note: Nokia changed the way in calculates market share earlier this year).

- Average selling price (across all devices) was €65, up from €64 in Q3 2009 and up from €61 in Q2 2010. Nokia says these changes were mainly due to a higher proportion of converged devices sales and currency fluctuations.

The average selling price of Nokia's smartphones was €136, down from €142 in Q2 and €190 in Q3 2009. This reflects the increased proportion of cheaper smartphones in Nokia sales. Nokia says this is consistent with their strategy to take the smartphone to a wider group of consumers.

- Smartphone shipments in the quarter were 26.5 million (up from 24.5 million in Q2 2010 and 16.4 million in Q3 2009). The year-on-year increase in smartphone sales was 61% and the quarter on quarter increase was 10%. The increase was driven by improved sales of mid-tier smartphones.

- Worldwide converged device (smartphone) marketshare was 38%, down 3% sequentially and up 2% year on year. Estimated global market volume (i.e. all manufacturers, all markets) was up to 70.4 million from 47 million, year on year, and from 59 million sequentially. This means that Nokia's smartphone sales grew just below the average pace of the overall market.

- Significantly, in Q3 2010, smartphones accounted for more than 50% of Devices and Services net sales (€3,613 million versus €3,560 million).

- Ovi Store downloads are now 2.7 million per day (equivalent to almost 1 billion per year).

- The number of miles navigated using Ovi Maps doubled in Q3 to 2.5 million km per day.

- Ovi Mail and Chat signups have now surpassed 17 million accounts.

Conference call notes

- Elop opened by talking about his first five week at Nokia and the way ahead. He said that he would "characterise Nokia as a landscape with unpolished gems" and it would be necessary to "more deliberately focus on strengths around a tighter strategy".

- In talking about Nokia's software platform he noted the importance the familiarity of Symbian and Series 40 as an asset for the company, and MeeGo ability to allow for a contemporary UI. However the biggest emphasis was on Qt and its ability to provide a cross platform solution for developers.

- Going forward Nokia will be focusing on Qt and Web (HTML 5) for application development on both Symbian and MeeGo. This applies to both internal (particularly notable) and external development. In a sense the underlying platform is becoming less relevant. This will improve software platform efficiency. More details in this separate news story.

- Elop indicated there would be a shorter period between the announcement and availability of new products and services.

- Elop noted that he was excited about Nokia's first MeeGo product, but that it would be a "2011 event". Previously Nokia was expected to make an announcement before the end of the year. He noted that he had met with the "passionate" teams working on MeeGo and was "excited" about what is to come.

- Nokia lost market share in Q3 "because [we] were not able to keep up with demand, particularly at the low end of our product range. We expect this to continue into Q4 and the start of 2011".

- In the Q and A session Elop noted, with regard to software platforms, that: "What I am most focused on evaluating is on ensuring Nokia has plan for sustainable differentiated solutions. This is about the hardware, the software platform, the application ecosystems and the services [as a whole]. We need a solution that allow us to differentiate from our competitors. When you consider other alternatives [in software platforms] it is unclear to me how we could main differentiation with other paths."

Rafe Blandford, All About Symbian, 21 October 2010

See also

Earlier results: Q2 2010, Q1 2010, Q4 2009, Q3 2009, Q2 2009, Q1 2009, Q4 2008, Q3 2008, and Q2 2008