Nokia's results are below market expectations; analysts were expecting a larger increase in profits and a more optimistic outlook. Nokia has projected lower than forecasted devices and service margins in the year ahead (and its forecasts for Q2 were cautious in general). These factors are the primary contributors to a falling share price this morning.

Nokia has been squeezed in the low end device market (Series 40). However, the results in the key smartphone segment are encouraging, with increased shipments and marketshare (beating the overall market average). There were also encouraging signs for Ovi Maps (10 million downloads), and continued growth from Ovi Store (9,500 content items for key devices, average active user downloads 8 items per month).

Olli-Pekka Kallasuvo, Nokia CEO, said:

"In Q1, Nokia delivered both year-on-year net sales and operating profit growth. We continue to face tough competition with respect to the high end of our mobile device portfolio, as well as challenging market conditions on the infrastructure side.

During the quarter, we also demonstrated our ability to deliver the Nokia smartphone experience to consumers on a global scale, with our smartphone shipments up by more than 50% year-on-year. The consumer response to the inclusion of our walk and drive navigation offering on our smartphones has been tremendous. Since launching in January, 10 million Nokia smartphone users around the world have downloaded the offering.

In infrastructure, Nokia Siemens Networks’ profitability benefited from a positive sales mix in Q1. I am also pleased to see encouraging results from the company’s focus on helping operators meet the challenge of the rapid growth in data and signaling traffic from smartphones."

As part of the release Nokia notes that:

"Nokia is planning to deliver a family of smartphones based on the Symbian^3 software platform that is targeted to offer a clearly improved user experience, a high standard of quality, and competitive value to consumers. We plan to launch the first smartphone based on Symbian^3 during the second quarter 2010, with shipments expected during the third quarter 2010."

This is being widely reported as a delay in introducing the first Symbian^3 handsets (initially expected to arrive on the market at the end of Q2), with some justification. Nokia did say they would deliver 'a major product milestone before mid-year 2010'. It is worth noting that both Nokia and Symbian have been careful not to be too specific about dates. Symbian's own roadmap says devices are expected in H2 2010.

On the conference call Nokia indicated that the Symbian^3 release was behind its internal plan. OPK noted that they would not ship the first Symbian^3 device 'before the quality meets the demand of the end user' and that it 'will improve our position in the high end' and that are 'very confident' about the Symbian^3 device portfolio.

The reality is there's a small time delay to Nokia's Symbian^3 device; it would appear to be a matter of weeks. However this does have a significant impact on Nokia's financial results (in Q2, Q3) and portfolio mix. The delay will impact the first device most, subsequent devices will be delayed much less (the platform advantage).

Nokia also indicated that it has shifted the planned introduction of Symbian^4 based products to 2011. Nokia continues to expect to deliver its 'product milestone' for its first MeeGo device by the end of the year.

See more earnings call comments below.

Points of interest

- Nokia mobile device volumes were 107.8 million units, up 16% year on year and down 15% sequentially (not unusual for Q1, which follows the holiday market). This is set against estimated industry volumes of of 323 million units, up 11% year on year and down 10% sequentially. Nokia's overall (phones) market share was 33%, up 2% from Q1 2009 and down 2% from Q4 2009 (note: Nokia recently changed the way in calculates market share).

Average selling price was EUR 62, down from EUR 66 in Q1 2009 and down from EUR 64 in Q4 2009. Nokia says this was mainly due to price erosion and the decline was slightly offset by a higher proportion of smartphone sales. The year on year change was partly the result of a greater proportion of lower end smartphone sales.

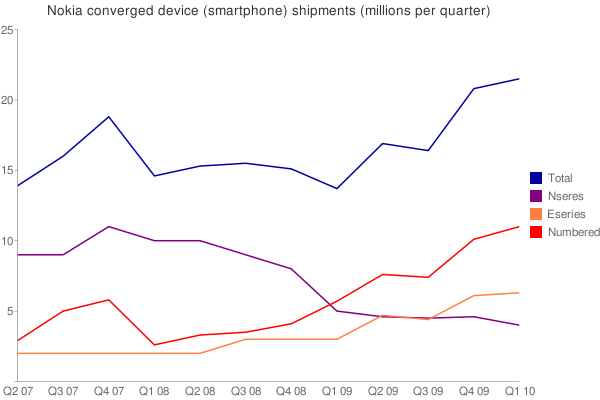

- Converged device shipments (smartphones) were 21.5 million (up from 20.8 million in Q4 2009 and 13.7 million in Q1 2009). The year-on-year increase in smartphone sales was 57%, reflecting improving economic conditions and a broader smartphone portfolio. Nokia did not release a breakdown of Nseries and Eseries sales (we have estimated them on the graph below).

- Converged device ('smartphone') marketshare was 41%, up 1% sequentially and 3% year on year. Estimated global market volume was up to 52.6 million from 36 million year on year and 52.4 million sequentially. This means Nokia's smartphone sales outgrew the market average. However, as we've mentioned before, sequential figures do tend to be quite variable, due to the fact that big individual launches can still have an impact on the relatively small smartphone market.

- Ovi Maps with free navigation has been downloaded 10 million times.

- More than 3 million Nokia Messaging accounts have been created.

- The most popular devices in Ovi Store have access to 9,500 items of content, operator billing is available with more than 60 operators and the average active user is downloading around 8 applications/content items per month.

Nokia smartphone shipments in recent quarters.

N.B. Eseries, Nseries, Numbered are estimated for Q1 2010

as Nokia has not released these numbers separately.

Notes from the earning call

- 18 million touch and QWERTY devices shipped last quarter.

- Top 8 converged mobile devices (smartphones) were all touch and/or QWERTY devices.

- More than 8 million Ovi Mail accounts.

- 72 operators deals with operators for Nokia Messaging (52 now active), 3 million accounts.

- 1.7 million downloads per day in Ovi Store.

-

With regards to our furst Symbian^3 device. We will not ship the device before it is ready. We intend to improve our position at the high end of the market. We are confident. The date when we ship the first Symbian^3 device will have an impact on our 2010 number and our outlook reflects this.OPK on Symbian^3 device: "With regards to our first Symbian^3 device. We will not ship the device before it is ready. We intend to improve our position at the high end of the market. We are confident. The date when we ship the first Symbian^3 device will have an impact on our 2010 number and our outlook reflects this."

Later on he added, "We will not ship the product before the quality meets the demand of the end user. It is [a delay] painful, but it is the right thing to do and is in everybody's interest."

In responding to a question about confidence in the Symbian^3 products OPK remarked upon the feedback from partners who are working on the product with Nokia. It was noted that the operator ranging KPI (key performance indicator) for the Symbian^3 products is very positive. - Initially Symbian^3 products will 'relatively high end'. However this will change over time. Other versions of Symbian will continue (e.g. C6, E5 type products).

Rafe Blandford, AAS, 22 April 2010

See also

Earlier results: Q4 2009, Q3 2009, Q2 2009, Q1 2009, Q4 2008, Q3 2008, and Q2 2008