The most obvious numbers in Nokia results is the 31% fall in profits, €295 million, down from €427 million, and a 40% decrease in EPS (earnings per share). This is primarily due to a fall in profits in Devices and Services, a consequence of decreased margins. Nokia's results were approximately in line with market expectations, with profits slightly lower then expected, but offset by slightly higher sales than expected. In June Nokia lowered its Outlook for Devices and Service in Q2, preparing the market for lower margins and resultant lower profits.

Nokia's smartphone performance at the high end remains poor in the face of competition from Apple, RIM and Android powered devices. However its overall smartphone performance, especially in the mid-tier, remains strong with sales increasing to 24 million, in line with market growth and maintaining Nokia's market share at 41%. Nokia is now looking forward to the release of the N8 and other devices which should improve its competitiveness at the high end of the market.

Olli-Pekka Kallasuvo, Nokia CEO, said:

"Despite facing continuing competitive challenges, we ended the second quarter with several reasons to be optimistic about our future. For one, the global handset market has continued to grow at a healthy pace, led by some of the less mature markets where Nokia is strong. We are also encouraged by the solid second quarter performance of our Mobile Phones business, helped by an improving line-up of affordable models.

In smartphones, we continue to renew our portfolio. We believe that the Nokia N8, the first of our Symbian^3 devices, will have a user experience superior to that of any smartphone Nokia has created. The Nokia N8 will be followed soon thereafter by further Symbian^3 smartphones that we are confident will give the platform broader appeal and reach, and kick-start Nokia’s fightback at the higher end of the market."

Nokia confirmed the guidance it gave in June for the outlook for the rest of the year. It expects overall mobile device volumes to be up 10% in 2010 from 2009 and that its market share will remain flat. Nokia expects the operating margin in Devices and Services to be between 7% and 10% in Q3 and 10-11% in 2010 as a whole (suggesting it expects a more positive Q4 2010).

These margins are lower than was predicted at the start of the year, reflecting Nokia's poor performance in high end devices. High-end device have the largest margins and Nokia is currently facing fierce competition from iOS, Blackberry OS and Android powered devices. The situation is expected to improve as the N8, other Symbian^3 devices and the first MeeGo device become available. However they are unlikely to have a significant impact before Q4 2010 and their full effect may not be felt until Q1 2011. As such Nokia Q3 results are unlikely to see any major changes from Q2.

Points of interest

- Nokia mobile device volumes were 111.1 million units, up 8% year on year and up 3% sequentially. This is set against estimated industry volumes of of 338 million units, up 14% year on year and up 3% sequentially. Nokia's overall (phones) market share was 33%, down 2% from Q2 2009 and unchanged from Q1 2010 (note: Nokia changed the way in calculates market share earlier this year).

- Average selling price (across all devices) was EUR 61, down from EUR 64 in Q2 2009 and down from EUR 62 in Q1 2009. Nokia says the year on year change was primarily caused by sales of a higher proportion of lower priced smartphones. The quarter on quarter change was mainly the result of price pressure, especially on higher end smartphones.

The average selling price of Nokia's smartphones was €143, down from €155 in Q1 and €181 in Q2 2010. This reflects the increased proportion of cheaper smartphones in Nokia sales. Nokia says this is consistent with their strategy to take the smartphone to a wider group of consumers.

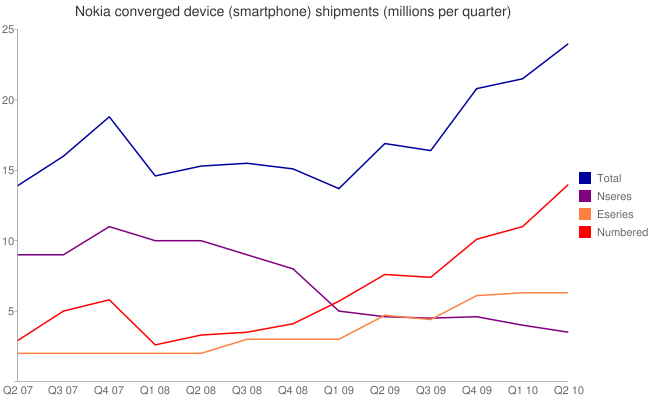

- Smartphone shipments were 24.5 million (up from 21.5 million in Q1 2010 and 16.9 million in Q1 2009). The year-on-year increase in smartphone sales was 42% and the quarter on quarter increase was 12%. The increase was driven by improved sales of mid-tier smartphones. Nokia did not release a breakdown of Nseries and Eseries sales (we have estimated them on the graph below).

- Worldwide converged device (smartphone) marketshare was 41%, flat sequentially and year on year. Estimated global market volume (i.e. all manufacturers, all markets) was up to 59 million from 41 million year on year and from 52.6 million sequentially. This means that Nokia's smartphone sales grew at the average pace of the overall market.

- In Q2 smartphones accounted for more than 50% of Devices and Services net sales (€3,429 million versus €3,369 million).

- Ovi Maps with free navigation has been downloaded 17 million times. Nokia also began including the free navigation version in all its GPS-capable smartphones out of the box.

- The most popular devices in the Ovi Store have access to 13,000 items of content. The Ovi App Wizard achieved 1 million downloads in just 10 weeks, with partners publishing 'thousands' of apps.

The numbers for Nseries, Eseries and 'numbered' (which also includes Xseries) devices are estimated for Q1 and Q2 2010.

Notes from the earnings call

- Kallasvuo, "Nokia will make a come back at the higher end of the market".

- Nokia will bring a family of Symbian^3 devices to the market and aim to ship 50 million Symbian^3 devices. Symbian^3 family of devices 'in place' for Q4.

- Nokia is leveraging "a software centric approach". The Symbian^3 software will be uniform across the range making it easier for Nokia's internal teams to maintain a "cadence of device releases". It was also mean that it will be "much easier for third party developer to make applications work across the range of Symbian devices".

- Symbian is about leveraging scale and covering a broad market foot print. MeeGo is about leveraging speed of innovation at the high end. They have "different sweet spots".

- It "takes more than a good product to succeed", logistic and distributions channels are important and "Nokia excels in these areas".

- Nokia has improved its performance in mobile phones (Series 30 and Series 40) this quarter in the face of fierce competition, especially from Chinese manufacturers. The successful launch of the Nokia C3 was a particular highlight.

- Looking to the future Kallasvuo said that Nokia was coming to the "end of a painful product transition at high end". "The N8 will mark the beginning of our renewal and going forward I believe we will regain leadership in our industry".

- Asked about the US smartphone market Kallasvuo indicated that Nokia regard the market as important, but Nokia ave faced challenges with operator relations and testing. He noted that earlier Symbian generations have not been able to get though operator testing in the US in a competitive time frame. This should improve with Symbian^3 and future generations. Symbian will be important in the US, but "we will need MeeGo in the US".

- N8 will start shipping towards the end of Q3. However the major impact (in terms of geographic launches and sales) will be in Q4. Nokia plan to launch the device with an array of services and software, both from Nokia and external partners.

- Asked about the relationship between Symbian and MeeGo, Kallasvuo said that "Symbian and MeeGo are the best combination for smartest devices. Our focus with MeeGo is for the highest end smart devices, beyond what is considered the current smartphone. Symbian is and will continue to be our core software platform; we will continue to have Symbian devices across our entire portfolio, both at the high end and low end, including the strong possibility of Nseries devices. Trying to tackle too much with one platform has proved challenging [in the past], but we do need to manage the dynamic here, it is about managing the road map."

- With Qt Nokia "aim for simplicity and productivity through common APIs. Developers can utilise the same APIs to port applications between Symbian and MeeGo without significant rewriting. However there will be richer functionality in MeeGo and related APIs to address them."

Overall market

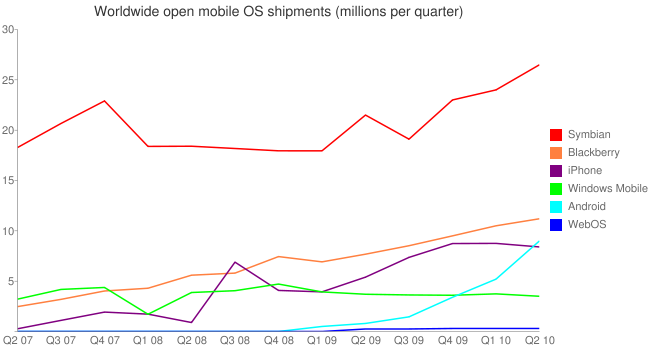

Nokia's increased smartphone sales should mean that Q2 2010 is the first quarter in which more than 25 million Symbian were shipped (estimate: 26.5 million). Here is a chart illustrating the sales of smartphone by platform over the last three years.

See also

Earlier results: Q1, 2010, Q4 2009, Q3 2009, Q2 2009, Q1 2009, Q4 2008, Q3 2008, and Q2 2008