Olli-Pekka Kallasuvo, Nokia CEO, said:

"The demand for mobile devices improved in many markets during Q3. With the average selling price of our devices holding firm quarter-on-quarter, our higher device volumes translated into increased net sales in our Devices & Services business. Our volumes and net sales were, however, somewhat constrained by component shortages we encountered across the portfolio. I also want to highlight the good operating expense management that helped the segment deliver solid earnings.

The challenging competitive factors and market conditions in the infrastructure and related services business necessitated non-cash impairment charges at Nokia Siemens Networks. We continue to support Nokia Siemens Networks actions to improve its performance."

Points of interest

- Net profits were EUR -426 million, primarily due to a write down in the value of Nokia Siemens Network (EUR -1,107 million). Profits from the devices and services division were EUR 785 million, down from EUR 1,469 million last year, but up from EUR 763 million last quarter. The Navteq division also "improved", with a loss of EUR -68 million compared to EUR -80 million last year and EUR -100 million last quarter.

- Nokia mobile device volumes were 108.5 million units, down 8% year on year but up 5% sequentially. This is set against estimated industry volumes of of 288 million units, down 7% year on year and up 7% sequentially. Nokia's overall market share was 38%, the same as Q3 2008 and the same as Q2 2009. Year on year market share was higher in Europe, Middle East and Africa, but lower in Greater-China, Asia Pacific and North America. Nokia noted that its devices sales were somewhat constrained by component shortages, which are expected to continue to some degree into Q4.

Net sales in the devices and service divsion were EUR 8,605 million, down 20% year on year, but up 5% sequentially. Operating profit in the division was EUR 785 million, down 50% year on year and up 3% sequentially. The year on year changes are largely the result of the economic climate, together with downward pressure on ASP.

- Services and software net sales were EUR 148 million, representing 29% year on year growth and 6% sequential growth.

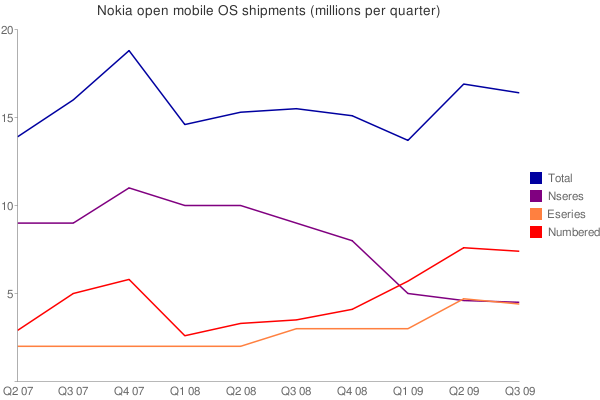

- Converged device shipments (smartphones) were 16.4 million, of which 4.5 million were Nseries and 4.6 million were Eseries (mainly E71 and E75). This reflects continued poor sales for the Nseries, but relatively healthy Eseries sales ahead of the E52, E55 and E72 mass market availability. Nokia continues to face fierce competition in the high end consumer market from Apple, HTC and Palm.

This means that 7.5 million smartphone shipments were numbered Nokia S60 devices, reflecting Nokia's continued strategy of pushing 'converged' devices into the mid tier (e.g. the 5800 XpressMusic).

Converged devices sales were, perhaps, a little lower than expected, reflecting the continuing fierce competitive environment. The Q4 results will be watched with interest as many of Nokia's more recent device announcements start hitting the market.

Nokia converged device results over time

- Nokia's estimated industry converged mobile device volumes (smartphones) were 47.0 million, compared to 44.2 million in Q3 2008 and 41 million in Q2 2009. Therefore, Nokia's share of the converged device market was estimated at 35% in Q3 2009, the same as Q3 2008, but down from 41% in Q2 2009.

-

Nokia Mobile Device Volume by Geographic Area:

(million units) Q3/2009 Q3/2008 YoY

ChangeQ1/2009 QoQ

ChangeEurope 27.1 27.4 -1.1% 23.3 16.3% Middle East & Africa 19.6 21.5 -8.8% 18.9 3.7% Greater China 18.5 19.8 -6.6% 18.6 -0.5% Asia-Pacific 30.5 33.6 -9.2% 30.3 0.7% North America 3.1 4.5 -31.1% 3.2 -3.1% Latin America 9.7 11.0 -11.8% 8.9 9.0% Total 108.5 117.8 -15.4% 93.2 10.7% - The average device selling price was EUR 62, the same as the previous quarter. The average device selling price for converged devices was EUR 190, up from EUR 182 in the previous quarter.

Notes from the conference call

- Q3 was a ,"solid quarter for Nokia Devices and Services business despite component shortages". Components shortages (e.g. camera modules) impacted the smartphone part of the business more than the rest of the portfolio . The component shortage also impacted other industry player.

- The formation of the Solutions unit is an important structural change that improves Nokia's ability to execute and innovate.

- Nokia shipped 1.8 million N97 devices, and 5.7 million touchscreen device £5% more than Q2 2009). Four further touch devices to start shipping in Q4: N97 Mini, X6, N900 and 5230 - something for everybody and there are more to come.

- The sales decline in converged devices was mainly due to older devices, the newer devices performed well in sales.

- Eseries devices sales were 4.4 million, the decline was primarily due to slightly slower E71 sales, but the E72 (the E71's replacement) starts shipping in Q4.

- Ovi Mail has reached 2 million users (the growth, from one million users to two million users, took place in half of the time it took to reach one million users), Nokia Messaging now has 35 operator partners (doubled in 3 months).

- EUR 908 million of Nokia Siemens Network good-will write down, no further good-will on the books.

- In general remarks, while answering a question on whether Nokia would do an Android handset (no, obviously): Symbian will be extremely competitive due to its openness, innovation enablement and telecoms legacy, although there is much to be done ('user experience needs to improve')... in general on Symbian, 'there's so much we have in the pipeline'.

See also

Earlier results: Q2 2009, Q1 2009, Q4 2008, Q3 2008, and Q2 2008