Revisiting last years predictions

The 2006 predictions seem just a little optimistic - however, as is often the case with such predictions, the main problem is that I was jumping the gun.

If you look back to Jan 2006, you'll see that I foresaw 20 or more S60 devices from Nokia - this was optimistic - there were, in the end, some 10 or so distinct devices, but if you include some of the regional variants or marketing (music editions) it is possible to get to more than 20(!) Samsung and LG did both show S60 devices, but I missed with the Lenovo prediction. I was also wrong about touch screen S60 devices too, it seems we will have to wait a little longer for these. I over estimated the number of S60 devices that would be shipped, though not by a huge amount; a contributory factor to this is that sales of OS 9 based devices took a while to take off.

Series 80, in the form of the 9300i, showed grace in age, although it looks like 2006 was its last hurrah. Looking back it has been a tremendously successful product line. It will be interesting to see how easily its E90 successor is accepted, as loyal communicator fans make the transition to a S60-based device in early 2007.

UIQ has had something of a mixed year with highs at either end. 3GSM saw the announcement of the M600 and W950, but delays to all three UIQ 3 devices put something of a downer on the middle of the year. However, the recent acquisition of UIQ by Sony Ericsson and the release of the W950 in time for Christmas (just) point to better times to come. I foolishly predicted 7 new devices, but even if you count Chinese variants there were only 4! The delay in the first three UIQ 3 devices also means my predicted device shipment numbers of several million are at least 3 months too early.

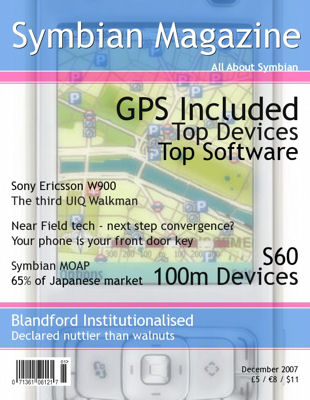

The '100 million Symbian devices shipped' prediction was correct and Symbian licensees are now well on the way to shipping 100 million devices in a calendar year, a staggering number if you stop to think about it. The 'Bill of Material costs' prediction was probably not achieved, although it is getting closer.

I was also wrong about the resolution of Symbian ownership issues (we're still waiting on this), the release of OS 10 (we got 9.3 instead) and more new licensees (we're going to have wait a bit longer for this one), although I did get some minor software updates correct.

I did best in the general ecosystem predictions - Google, Yahoo and MSN have all started showing more interest in mobile matters, with specific attention paid to Symbian based devices in some cases. VoIP services have indeed become available, but as predicted have not, as yet, made much of an impact.

Finally to prove that not all the predictions were over-optimistic - there were actually more Symbian OS based NTT DoCoMo/FOMA devices announced than I thought there would be.

And so to my...

Predictions for 2007

Devices and Software

Symbian licensees will ship around 70-80 million devices in 2007. This means that cumulative shipments will be just under 200 million.

Symbian licensees will ship around 70-80 million devices in 2007. This means that cumulative shipments will be just under 200 million.- We will see more diverged-converged devices. That is to say devices that have a primary task at which they excel, at a design cost to other features. Current examples of this include the Nokia N91 (music) and N93 (video). However such devices will not lose functionality since the majority of functionality is within the software platform and as such they will still be converged devices. This trend is driven by marketing and the need to create products attractive to specific user segments. There will, of course, still be devices that are marketed as 'do it all' in the vein of the Nokia N73 or (more sexily) the Nokia N95.

- There will be more devices with integrated GPS, precipitating signs of a renewed emphasis on location-based services and software. Bluetooth-enabled GPS navigation has been one of the most popular add ons for smartphones in 2006 and integration into each device will make this even more attractive to users. Integrated GPS will also add location data to existing functions (e.g. geo-encoded camera pictures).

- The first signs of wider consumption of user generated video will appear. Future Nseries devices will ship with an application that allows you to download and view (video) content from sites such as YouTube and Google Video. There may even be software to allow direct uploading to the same sites, contributing smartphone-shot video clips without needing a PC to host them first.

- 2007 will see the 50th S60 mobile phone announced (we are on number 46ish at the moment). There are likely to be as many as 15 distinct S60 phones from Nokia, together with a number of marketing variants. Samsung and LG also seem set to announce further S60 models and there will be S60 (and Symbian) first timers in the form of Asian based OEM manufacturers using the Freescale Reference Design.

- The Nokia E90, the new communicator, will make an appearance early in the year. It will be one of a number of Eseries devices which will widen Nokia's Enterprise portfolio. A number of the existing Eseries family will also be refreshed or replaced. There will be further Nseries announcements this year. There will be a continuing trend of multimedia computers (led by the N95), but we should also see some style-centric S60 phones. A thin style RAZR-esque phone is likely to be seen early in the year. There will be an increasing number of mid-range S60 smartphones targeted at specific segments, following in the footsteps of the Nokia 6290 and Nokia 5500.

- There will be an emphasis on gaming in the second half of the year, with the launch of Nokia's next generation gaming initiative. This will use some existing S60 3rd Edition handsets and some, as yet, unannounced devices, all probably with advanced hardware-accelerated graphics. There is unlikely to be an 'N-Gage' successor, but there will instead be a gaming-optimised device (in the same way that the N93 is video-focussed).

- Against most people's expectations, and sharply contrasting with the mixed fortunes of 2006, UIQ Technology will have a good 2007. A significant trend will be the move into mid tier devices (following the W950's lead), which should lead to higher volumes in the latter half of 2007. Extra resources will be available to UIQ Technology following the Sony Ericsson acquisition, although the fruits of all this may have to wait until 2008.

- Sony Ericsson will announce up to 5 new UIQ 3-powered devices, from mid range to the high end. Among these will be the first non-touchscreen UIQ devices. We can expect to see the first announcements at 3GSM with follow up announcements later in the year. UIQ will also have success outside of Sony Ericsson in 2007. Motorola should announce its first UIQ 3 device at 3GSM and there are persistent rumblings of news from other avenues too.

- There will be 12 more Symbian OS powered MOAP handsets as Symbian continues to do well in the smartphone market in Japan.

Symbian OS and Updates

- Symbian's OS product release cycle dictates that there will be a new version of the OS released to its licensees this year.

- Similarly, updates to both UIQ 3 and S60 3rd Edition are very likely. There is a good chance these may be announced at 3GSM.

- With manufacturers using reference designs (such as Freescale's), there will be a number of 'new' Symbian OS licensees/manufacturers this year. Devices from these companies may be branded by operators such as Vodafone and Orange, who have already chosen 'S60 on Symbian' as a preferred platform.

- The Symbian ownership question remains unresolved. It seems likely that Symbian's board will move to clarify the position with regards to non active licensees/shareholders, such as Siemens and Panasonic.

The Mobile Ecosystem

The Mobile Ecosystem

- Linux as a mobile platform will fail to live up to the hype. While it will be Symbian's main competitor in the mid tier space, the reality of its fragmentation and its true cost will become more apparent. It is likely that several of the most hyped Mobile Linux projects will arrive late and will be underwhelming which will raise questions about its suitability as a software platform as devices become more complex. On the other hand, shipment numbers are likely to be healthy as Linux takes over from the proprietary OS in the lower mid range.

- Windows Mobile will continue to provide Symbian's principal competition in the high end part of the market. It will receive a boost, particularly in the enterprise segment, with a major new version of Windows Mobile (Crossbow), which is expected to be announced at 3GSM. However, in the mainstream consumer market it will fall further behind.

The Internet giants such as Yahoo and Google will continue to show interest in mobile, but progress is likely to be slow. However we can expect to see more of each of their respective services mobilised and a more coherent overall offering.

Challenges for the year ahead

The challenges facing Symbian and its ecosystem have not changed much from 2006. Symbian continues to struggle against the perception that it is Nokia-dominated. There is no escaping this, although healthy shipments of MOAP and UIQ devices should help silence even the most vocal criticism. With Sony Ericsson's acquisition of UIQ Technology, Symbian can now concentrate fully on the OS layer.

- Symbian must focus on proving its worth to its licensees while at the same time encouraging them to work together for mutual benefit. With little or no leverage over its licensees this is a difficult proposition. Thus far Symbian has been content to work quietly and unobtrusively, but as market leader Symbian should be showing leadership and pointing the way both for the rest of its ecosystem and the mobile industry more generally. Part of the challenge for 2007 will be demonstrating its ability to do just that.

- As with 2006, S60 still needs to prove that it can be successful for licensees outside of Nokia. Announcements from LG, Samsung and a number of manufacturers are encouraging, but the proof is in the pudding. S60 faces its most significant challenge in ensuring that it provides a compelling and usable experience across an ever increasing range of devices and target segments. With as many as 40 applications available out of the box, S60 should be wary of the danger of confusing and driving away novice users. At the same time, high end users will continue to demand more functionality and a refresh of (and addition to) the feature set. A tricky balance to get right. The trend to educate users about their devices must continue, there is a disconnect between what the devices can do and what people use them for.

- UIQ Technology has come under a lot of criticism in the last few years and in 2007 it must answer its critics and produce visible results. Its technology and ethos may be more than a match for S60 and other competitors, but until this is delivered into the hands of consumers it remains theoretical. Sony Ericsson created a lot of excitement about the UIQ 3 devices and has (somewhat inevitably) failed to live up to the hype - the P990 in particular has suffered from delays and software problems; it should look to address this in 2007. It will also be important for UIQ to prove it can work with device manufacturers outside of Sony Ericsson, lest it face similar questions over licensing strategy as S60.

- Symbian and its partners must also address some of the concerns of the wider ecosystem. The third party software market for Symbian is in relatively poor health and despite the very healthy device sales numbers ISVs (developers), with a few notable exceptions, are still struggling. While there is general, although not universal, agreement that third party software market can add a great deal to the smartphone offering, it will not be magically created. This is one of the greatest challenges facing Symbian and its partners - get it right and a golden halo is created around your platform, as it was for Palm in the mid to late 1990s.

Rafe Blandford, All About Symbian, 2nd January 2007