I don't pretend to have Rafe's encyclopaedic knowledge of the industry (here's his summary of the results) but I can spot a worldwide trend as well as the next (non-American) unbiased observer. It has been downright annoying over the last year or so hearing podcaster after blogger after analyst from North America all proclaiming that Symbian is dead, that Nokia is dying, and that Apple (and to a lesser extent Android and RIM) is the future, a runaway success.

Now, don't get me wrong, I love Apple too - I own two Macs and numerous iPods and other white accessories(!) - and yes, the iPhone is a lovely piece of engineering that is rightly enjoying huge success across the world. I have no problem with that at all. I also have no problem with RIM and their Blackberrys, the Bold 9700 is a stunning device and their messaging services continue to win fans. Ditto Android, the new OS on the block, which shows great potential and I don't doubt that it'll be a major player over the next few years.

But Symbian dead? Cough. I don't think so. Even in its darkest period (also known as 2009, while the entire OS had to be checked for licensing and overhauled in a multi-stage process), it seems that sales of Symbian-powered smartphones have remained steady, at worst and risen, at best.

The much-talked about push of Symbian down towards lower-priced phones, seen by some rather snobbishly, can surely only be a good thing, both for users, who get their hands on a fully multitasking, fully functioning smartphone for a lot less money than before, and for the Symbian Foundation, whose OS gets into far more people's hands.

Far more hands equals higher overall sales numbers and potentially higher market share, though we do have to take into account the growth of the smartphone segment overall and the growth of Nokia and Symbian's competitors. In any case, I wouldn't expect Symbian's current worldwide smartphone marketshare of 45% to be dented too significantly, despite the onslaught of competition - and it's even possible that market share will rise.

All of which will utterly confound the North American press, for whom Nokia and Symbian are a complete enigma. Listening to the American podcasters (e.g. Cranky Geeks, here), I've heard them try to rationalise things by:

- splitting 'smartphones' into 'real' smartphones (devices with large touchscreens and widely stocked app stores - they're thinking iPhones and Droids, and so forth here) and 'almost feature phone' 'not-quite-so-smart' phones (meaning Symbian phones)

- taking things further by inventing a whole new class of phone, the 'app-phone'. The assumption here is that Symbian-powered phones can't really run add-on applications. Aside from high performance games, most of us would dispute this claim, I suspect. Symbian-powered (and before 2000, EPOC-powered) phones, communicators and palmtops have been running add-on applications since 1993, a full decade before the iPhone was a gleam in Steve Jobs' eye and Android was a gleam in Andy Rubin's

I can understand their frustration, I really can. The American market is so dominated by carriers and by heavily-subsidised, contract handsets. In this sort of environment, an expensive iPhone 3GS (for example) is easily disguised in a $70 a month, two year plan, whereas Nokia phones have to be bought up front and a voice/data plan then added from the aforementioned exorbitantly priced carriers. In the rest of the world, we've both got Nokia and Symbian-powered phones readily available on cheaper contracts from all carriers in almost all countries, plus it's also often practical to buy them without a contract and then simply use a pay-as-you-go SIM.

I can also understand the desire to split the market up into two distinct segments: large-screened, touch-driven phones (where the iPhone can dominate, stats-wise) and smaller-screened, usually button-driven phones (where Nokia can 'safely' be pigeon-holed and allowed to dominate, without risk of embarrassing the likes of Apple and Google). In fact, in an upcoming Phones Show, I'm going to split my usual 'Top 5' celebration into two Top 5s - for touch and non-touch, for each have their own pros and cons and it is rather artificial to compare the stats for, say, an iPhone 3GS and a Nokia E63 - utterly different form factors at different prices for different markets.

However, things aren't as clear cut as that. Phones like Nokia's 5530 XpressMusic, a candybar, full-face touchscreen smartphone with (nearly) ubiquitous kinetic scrolling and all the usual apps, including the much-improved Nokia Ovi Store (for apps), all for £130 or less, confound the above reasoning. The 5530 is quite clearly inferior to the iPhone 3GS in several ways (though also superior in a few, too), yet it's something like a quarter the price.

Which is where I came in. Nokia's strength in the smartphone world is its range. Firstly, in terms of number of devices (we'll leave the argument that they've produced too many designs for another day!), from £100 (all prices in this article are contract-free, by the way, so that I can compare like with like, etc) button-driven candybars, through touchscreen and qwerty-driven candybars, to mid range messaging smartphones, to media-centric touchscreen tablets, to high end imaging phones and touch/qwerty hybrids at £450 at most.

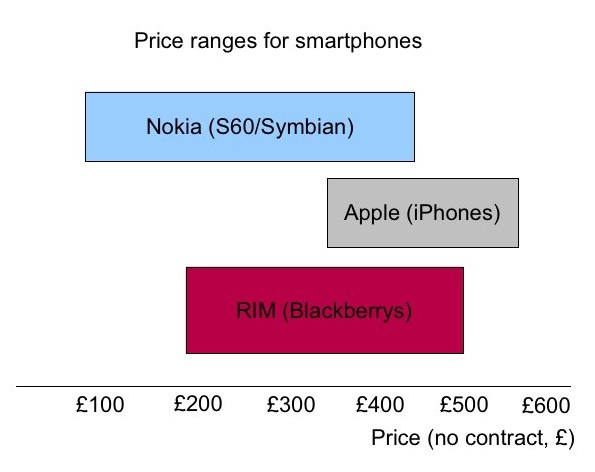

£100 to £450 - that's quite a range. In contrast, Apple's iPhones start (contract-free) at £340, for their lowliest 3G model, up to £560 for the highest-spec 3GS unit. Looking at these ranges on a chart, it's apparent that the overlap between Nokia and Apple, in terms of market positioning, is relatively small. I've also added in RIM, for interest-sake.

Secondly, there's geographical 'range' to think about. Most phone manufacturers have made an effort on most continents (with the notable exception of Nokia in the USA, somewhat ironically and paradoxically!), but Nokia has the largest distribution network of all and is a reliable, prestige, top-end phone brand in countries which haven't even seen an iPhone or Android-powered phone yet.

And it's these countries which are increasingly adding to the worldwide sales figures and to market share calculations.

Does all this mean that Nokia and Symbian are going to rule the world? Maybe, but that would be a very blinkered view. What it does mean is that Nokia's range overall, and their range in smartphones specifically, gives it a real edge in terms of getting powerful, extensible phones out to more people on more budgets than its competitors.

A final thought is that sales of 'smartphones' ('Converged devices', in Canalys speak) are still only about 20% of the overall phone market. (This has historically been limited by pricing issues, but with Symbian becoming ever more accessible in ever cheaper phones, this figure will surely rise.) Leaving a huge growth for smartphones of all sizes, prices, form factors and persuasions. Apple's and RIM's and Nokia's and Samsung's (and so on) smartphone sales could all double without significantly affecting each others bottom lines - the take-up could all be from within the traditional 'feature phone' pool of buyers.

This is still a marketplace that has a lot of growing to do.

Steve Litchfield, All About Symbian, 30th January 2010