Anyone with half an eye on the news will know that the world's economy is slowing down, and most countries are expected to be in a recession in the near future (if they're not in one already and the politicians are just hiding the fact). What does this economic slowdown mean in the technology sectors, for smartphones, and the Symbian ecosystem in particular?

Well, if we start at the top, the two major companies involved, Nokia and Samsung, are looking pretty rosy. Nokia, of course, (assuming legal hurdles are cleared), will acquire Symbian as a whole at some point in 2009. Yes, they are paying for that, but the cost is roughly the same as the cost of Symbian device licences over eighteen months to two years. So in that respect it's not actually costing them anything, and they gain a lot of knowledge from the staff and developers who will come under the Nokia banner - only a handful will head over to the Foundation, while the rest remain as Nokia employees.

Well, if we start at the top, the two major companies involved, Nokia and Samsung, are looking pretty rosy. Nokia, of course, (assuming legal hurdles are cleared), will acquire Symbian as a whole at some point in 2009. Yes, they are paying for that, but the cost is roughly the same as the cost of Symbian device licences over eighteen months to two years. So in that respect it's not actually costing them anything, and they gain a lot of knowledge from the staff and developers who will come under the Nokia banner - only a handful will head over to the Foundation, while the rest remain as Nokia employees.

That is where the real cost to Nokia is, the cost base of Symbian's employees and property will be on Nokia's balance sheet, but that should be easily absorbed into the company.

In a sense Nokia's purchase of Symbian guarantees it in some form - a company whose sole product is a licenced operating system, and the consultancy services around that, compared to a division of one of the largest electronics manufacturers on the planet. And that's before it moves to open source over 2009 and 2010.

Samsung Electronics are on a roll. Now the second largest mobile manufacturer (after Nokia), 2007 saw them break the $100 billion mark of sales for the first time over all their products. Having them make a commitment to Symbian - as can be seen in the recent push on their Developer Forum - in the knowledge of the Foundation plans, they must be confident of continuing success and the ability to have the OS supported for their devices.

It's unlikely that people will stop buying phones tomorrow, but there will be a slow down in consumer spending. I don't actually think this will make a huge difference over the next year. Most companies have a product range planned out a good year or two in advance, and, while it is an option to drop a model or two, that would mean waving goodbye to the development costs - something I don't think likely in the present environment.

And the networks are going to want a steady supply of new handsets. They want people to sign up for contracts, although 18 and 24 month long contracts are likely to be the norm in the UK through 2009. So I don't see a slowdown in the handset design or availability. They're planned out far enough in advance, and everyone in the supply chain is expecting them. There might be an impact on late 2010, but that could be the earliest major effect.

I doubt people are going to stop using mobile phones in large numbers to keep their budgets under control, but they are going to have a keen eye out for special offers, tariffs that will reduce their monthly costs, and they won't have any qualms about moving to a new network (increasing churn) if they do get a better offer there (and attractive handsets). I think the networks are going to be squeezed and have reduced APRU, probably from mid 2009. They're not going to go away, but they will have to balance just how much money they can get out of each of their customers.

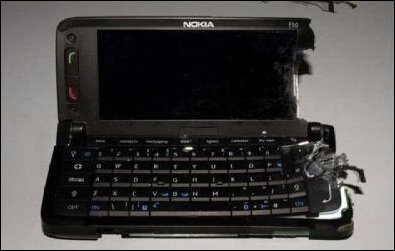

This could be where the 'Pay as You Go' Symbian handset becomes the 'killer' for the platform. People will want new phones but, conscious of the cost, are going to be looking more at the mid and low tier markets for their new handsets. And arguably PAYG helps budgeting if the recession gets really bad. The plan for Symbian has always been to come into the mid and low range (witness the recently announced E63 that fits this bill almost perfectly) and, just as these conditions happen, the world looks like it's ready to buy cheaper phones with more functionality as people tighten their belts. That's the perfect set of circumstances.

Smartphones are not just hardware and operating systems, but the software that runs on them. A strong ecosystem will always have strong software from third parties. Symbian has become rather stratified over recent years, with a few big name houses, a few in the middle, and rather less at the hobbyist/boutique level. Any economic difficulties are going to alter those three areas.

The top level, big name companies are likely to have the least amount of change. Many of them have bundle deals, with their software going into the firmware of devices. As the devices continue, so will the royalty payments. There may well be a squeeze, partly as consumers on longer contracts have less reason to churn handsets, but also as manufacturers perhaps squeeze the royalty rate. What's unlikely to happen is for them to be deleted from the device, so they have guaranteed income over the next year or so.

There is another area in this upper tier which should weather the storm, albeit a little bit battered, and that is the bespoke 'code to order' development studios. When people think of third party software developers they normally think of software installed by end users. However, the majority of the ecosystem outside Symbian and the phone manufacturers is in software service companies who provide a component for the platform or help with integration of software and hardware. Even in end user installed software there's more activity around bespoke applications for enterprise or operators than there is in the direct to consumer space. With the emergence of the Symbian Foundation, service software companies may be busier than ever, although this could be an area where companies (not just manufacturers, but those requiring code for their workforce to use) will be looking to cut costs.

The middle tier, I think, is going to face the brunt of the damage. These are the companies with a number of products on the market, that perhaps have their own web site-based store powered by the likes of the software store companies (e.g. Handango), but are reliant on selling x amount of applications each week to make the pay cheque. They're not the big hitters of the Symbian world, but do have a presence and would be missed if their cash flow hits problems. In a downturn, with less spare cash for leisure, the companies relying on that for income are going to be hit. Expect to see a few of these go to the wall (or at least attempt a switch to other platforms), or get downgraded to individuals and almost hobbyist web sites.

Which is interesting, because that third base layer, of hobby software, I think has a chance to become much bigger. And that's down to two factors. The first is more 'regular' programming languages coming to Symbian, in the from of Qt, Ruby and Python. That means people don't have to learn new tools. The second is because of the lay-offs in the tech sector that have started already. With more people who like to hack and fool around with computing, there could be an explosion of idle hands looking to do cool things - the Symbian ecosystem needs to make an effort to catch these people before they reach other platforms.

Developers focussing on lesiure and gaming products will have to deal with a two edged sword. Recessions have a habit of encouraging people to stay at home or look for low cost entertainment (there's an interesting case matching the rising sales for the cinema when compared to a sinking economy). Gaming, to a certain extent, may be regarded as 'recession proof', but it is going to become a very crowded market, and you need to be constantly releasing new titles and ideas. It's also one area where piracy could be a real concern.

Most of these ideas will stay as small one or two man projects, because the VC market to fund new projects is going to take a massive hit. We're already seeing Web 2.0 companies that have been worrying about growth before profit having to seriously slim down their staff. Starting a new company that needs huge running costs or a large war chest of funds is going to be tricky in a downturn. It's unlikely we'll see speculative companies looking at bleeding raw edge technology (such as live streaming video) gather a lot of VC funding for them to build up membership while leaving revenue generation to a much later date. Mind you, the rule of thumb is that 70% of start ups fail, so 80% fail in a recession might not seem a big change, but its the terms of the offer, the money, and the amount you have to give up that will change and make VC funding less attractive. And if funding is achieved, there may be a more inclincation to code in-house at a lower cost (with longer lead times) than outsourcing code to the bespoke developers.

I think the one exception to this would be if someone came up with a really good way to index, catalogue and search software. One of the biggest problems at the moment in the third party software world (on any device) is discovery. With all these applications out there, how do you find the best software for your personal needs? For all the delights of the iPhone App Store, once you've slipped off the front page and the 'Top 25/50' pages, your sales fall off a cliff edge. If someone sorts that out they will have a winning business idea.

Image of Nokia House by moleitau

To sum up the software prospects, expect to see more software, from smaller teams, and perhaps with less grandiose visions than we're used to.

The ecosystem of Symbian OS ties together all the parts of the value chain that I've mentioned here - there is ebb and flow and change in one area will reflect in other areas. From what I can see, all the parts that need to be working well are doing so. There are areas that need to be carefully tended as the economy worsens, and some could do with a lot of care and attention, but there is no reason to think that the recession is going to kill off the smartphone. A re-evaluation and perhaps some changes, yes, but I don't think the recession will touch the smartphone market to a great extent.

-- Ewan Spence, Nov 2008.