This feature article is a write up of the Engineering with a Business Plan session held at Orange Code Camp 2005 in Opio. Further details of the Orange Partner Program and future Orange Partner events are available on the Orange Partner website.

John Pagonis, from the Symbian Developer Network, gave a presentation that focused on the business side of the mobile development story addressing the 'apparent opportunity of entering the mobile phone application markets as an ISV'. While the technical development ability of small start ups is usually not in question the challenges faced in running a business, especially for someone from a technical background, are often under estimated and are at the root of most failures. Marketing and Engineering are most essential components in the recipe for a successful start up.

In explaining why he was giving the presentation Pagonis said that he wanted to help developers to develop and underlined that Symbian needs developers to succeed – to be in business and keep developing for Symbian OS and concluded that 'dead developers did no-one any good'.

Delegates were reminded that the potential market for Symbian OS solutions was very large and continuing to grow (100 million devices next year). Symbian has 80% plus marketshare, but this varies geographically in both share terms (the US market place at 30% being twice as small as the next smallest China with 60% and three times as small as EMEA 90%) and in size terms (EMEA being bigger than all other markets combined).

The starting up process was simplified down to a seven stage process:

1. Opportunity

2. Spotting the need(s)

3. Building the team

4. Building the infrastructure

5. Creating the product

6. Marketing the product

7. Staying in business.

Pagonis argued that there is a opportunity within the mobile and Symbian marketplace pointing towards to 40 million and growing installed user base, the low barriers to entry, the general belief that mobile is the next big thing, the potential for mobile to be the next frontier for enterprise, and perhaps most importantly the fact it is a nascent market ready to be harnessed.

However a critical problem is often a lack of information with little information on question such as who is buying software for their phone, or where, how and why do they buy? Question remain about segmentation, pricing, the addressable market and the trends and patterns in the future. A paucity of information is one of the major stumbling blocks for start ups. Pagonis' partial answer to this was that as far as independent mobile software business is concerned, we are circa early 80s when comparing the mobile and PC story line. There has been no VisiCalc (killer application that makes you buy one particular phone), most predictions are wrong (e.g. 640kb will be enough), and no one has yet sold as many as the Psion's ZX81 Spectrum Flight Simulation (1 million). However by contrast we do have more knowledge, the Internet, more potential users, and better tools and an open platform on which to work. If success was possible in the 80's environment then it is possible now. Pagonis asked the audience to consider the thought that given the parallels and the 'success of those who got software 'right' in the 80's who would you want to miss out' on the opportunities of mobile software?

Pagonis pointed out success was possible for smaller teams than those found in the traditional software market. He pointed towards the ‘Return of the homebrew coder’, ( from The Economist, March 11th 2004) which argued that 'Most modern software is written by huge teams of programmers. But there is still room for homebrew coders, at least in some unusual niches' and that new technologies (broadband, VOIP, IM etc.) allowed for low cost dispersed team development. However, despite this, building the team remain the most expensive and difficult task in developing software. Pagonis warned that there is a need for domain specific knowledge – a realisation that mobile is different and should be treated as such and that although dispersed development is possible it is harder.

Delegates were then told that the language selection for development (between Java, C++ and others) is not always as clear cut as it may first appear. There is a trade off between available functionality and time to market (TTM), and while Java may have quicker development times because of the need to train people to Symbian OS C++ before you can deliver, it may be necessary to wait for a particular JSR to be realised and deployed on mobiles (while competition deliver in C++), therefore the TTM to market question is not simple. Despite Java's movement away from MIDP origins and it's increasing functionality and power, in general in order to develop with cutting edge functionality or more power it will be necessary to use C++ as it will always be ahead of Java because of the deployment lag of JSRs and the respective nature of the languages. This difference is on the of big trade off question for start ups to consider.

Having spotted the opportunity and built the team the nest stage is to budget – looking at factors such as R&D cost base, pricing, net price, distribution, promotion, infrastructure, and crucially the sales cycle (which is the basis of the budget because it determines cash flow). There is a scarcity of information in this area with the product cycle for mobile phone application still emerging, with differences between enterprise and consumer, for middleware, and reliance on mobile phone sales cycle still unclear. Pagonis said this is a market that is 'happening... happening... happening' and therefore you can not size a non existing market easily.

Pagonis offered the observation that this market is familiar – developers don't have software pre-loaded, software is not sold by retailers, electronic software distribution is the norm, and try and buy is offered that this offers a high correlation to the situation found in the PC/Mac shareware market. It is by looking at this correlation that we can gain information, look at the problems and the potential solutions because there is a lot of information and a lot to be learned.

The sales cycle shows that sales are high for a short period after release (a week), and then declines for one to three months before entering a period of much slower decline (a long tail). Pagonis noted that there were sales peaks around major and minor releases (and that therefore a release often policy to generate more peaks might be favourable), that the ability to vary price according to point on the sales curve is very important, that customers will buy at any time and you must be available for them including the capacity to deal with them at peak periods because the relationship with your customers is key, that you software development efficiency will determine your business sales and vice versa.

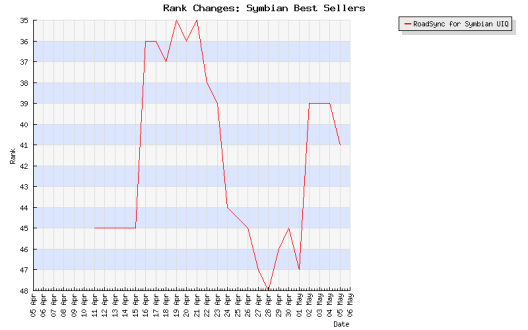

Two examples of the sales cycle as seen through rank on the best seller list. The first peak is release. The second peak is likely due to an update release and or marketing campaign. Source: Internal AAS / Handango Tracking Data

Note: This is illustrative information provided by AAS and was not part of the infromation presented in the session.

Pagonis also offered several key point to consider: firstly that is is vital to make software easy to download, install and buy, secondly try and buy creates a hysteresis into the download to sales conversion rate, and that defects (including difficult purchase or installation regimes) will result in being swamped with support requests. The sales peaks mentioned previously happen because of the 'exposure and promotion of new software through online (and other) media'. These include on line reviews, press releases, mentions in blogs, for a and newsgroups, on line catalogs (what's new lists), on line adverts, inclusion in magazine CDs and magazine reviews.

Pagonis then walked delegates through the Electronic Software Distribution (ESD) channel and pointed to two kinds of portals – the ones you sell through, and the ones you promote though and in contrast to shareware we have far more of the first in the mobile software industry and that there both good and bad portals. He advised developers to go through a check list – looking at whether the terms and conditions are fair, whether they offer any promotion, what the availability of the store is like, is your preferred licensing scheme integrated, who handles supports, is fine grained selling and demographic data offered, at what cost do they offer these services?

A big question is whether an ISV should do the the sales process themselves. In this case it is necessary to do all the promotion yourself (promotions, reviews, banners ads, press releases, catalog building) and the maintenance and running of the store. It is important to realise that a store must be available, must integrate with registrationand payment services, cater for VAT globally, needs to store records for up to 7 years (UK), needs a customer payment and support channel, and must comply with data protection and distant selling acts (UK). Fulfilling these needs is not as hard as it sounds, but the costs both financially and in time terms should be considered when comparing the DIY route against the ESD route.

Pagonis also touched on the subject of license registration and locking and ask delegates to question whether there was a need for it, pointing out that it was important not to make it hard for people to give their money, and not to upset them after they have done so. Symbian research has shown that many people (up to 40%) who do pay, have registration problems with license keys/tokens, and once trust is broken it is often irretrievable. Therefore it is important that anything developers do should be well integrated into their store.

Finally Pagonis noted that there are other routes to market such as shrink-wrapped products, on memory cards through retailers, through operator deals, through manufacturer deals, through retailer deals that offer pick-n-mix services and using some purchase agents on the phones (offered by some application portals). Although these are not as important as ESD at the moment they offer further area for growth. There is also a channel of marketing business to business, and this model is keeping many Symbian software companies in business with offerings such as branded or customised applications, bespoke solutions using pre-existing in house components, middleware solutions for enterprises, and components sold to other developers.

Pagonis concluded by reminding developers that it is the applications of today that get included with the phones of tomorrow, and that it likely than rather than one VisiCalc killer application we will have a cocktail of applications that makes people buy phones.