The numbers were not disastrous

In the current challenging economic climate, growing smartphone shipments 36% year on year really isn't bad at all - many phone manufacturers have fared worse. Likewise, the N8 selling around four million units in Q4 despite supply/component shortages is pretty good for an individual device, especially one with a stated specialism (camera). Even market share, which has slipped a bit since 2009, is still healthy enough in pure numbers terms - how many tech analysts would believe, given the amount of positive coverage that Android has had in the last 12 months, that Symbian still powers more smartphones sales across the world (314,000 new Symbian smartphones sold per day) than Android?

Market Share is not forward looking

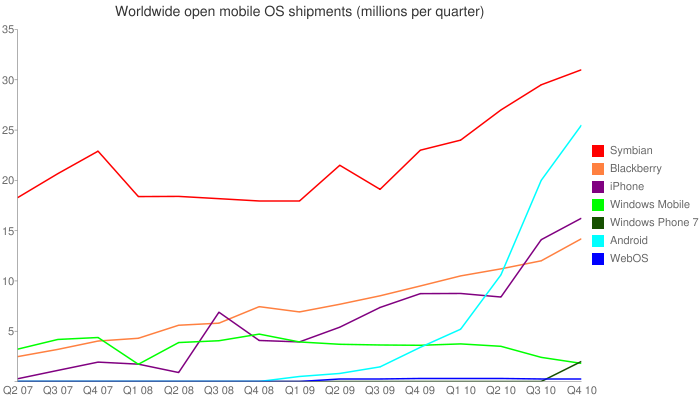

But let’s be clinical here. The market share numbers of Symbian, Android, iOS and the other handsets tell us what has happened. They do not tell us what will happen. Yes you can extend the curves, extrapolate the results, but that does not take into account new devices, different press and marketing messages that could come out. It’s accepted to use the numbers to predict doom or glory, but strictly speaking, as each quarter starts, everyone’s count is reset to zero. Humans are great at spotting patterns when none are actually there, and creating curves on graphs, well, Rafe is great at making curves.

Neither is Share Price a good indicator

On the news of Steve Jobs leave of absence, the Apple share price dropped a significant number of percentage points. It’s now back to where it was, after everybody has taken time to look at the implications of the announcement and seeing what is actually happening. Short term speculators are not in it to predict the future of a company, they are in it to make money in the short term. Snap judgements make for great copy, but they’re not indicative of a company’s trajectory.

There’s still a lot of love for Nokia in the room

Three hundred and fifty discussion comments on our thread about the news yesterday shows that people are still interested in what Nokia are up to. Yes some of them are going to be hoping for a car crash (and we might have moderated a few more away had we wanted to) but many are wanting Nokia to get it right. They’re looking for leadership, they’re looking for a lit path for the company that launched the first smartphone (and therefore had, by definition, 100% market share at one point!). They want to believe and are looking for something to latch on to. That emotion needs to be captured by Nokia during the next six months.

Nokia's SXSW party in Austin, texas. Picture by Dan Patterson, Flickr.

The issues around the American networks aren’t going away

Tucked away in the 20-F filing (a statement of the company’s position to potential investors, PDF link), in the list of “Risk factors”, was Nokia’s corporate thoughts on their relationship with the US networks. In short, it’s not good and unlikely to change in the near future:

Certain mobile network operators require mobile devices to be customized to their specifications with preferred features, functionalities or design and cobranding with the mobile network operator’s brand. Currently, this is particularly the case in North America…where sales to mobile network operators represent the major percentage of our sales. Moreover, the increased concentration among the mobile network operators, particularly in North America, has resulted in fewer [network] customers whose purchase preferences may differ from our current product and services portfolio, and in increased reliance on fewer larger customers.

With little commonality in what the networks want from a phone and what Nokia are currently offering, it’s tough to see how Nokia can get a foothold back in the US market. Add in their thinking that networks are focussing on having a smaller pool of suppliers and their inclination to not dilute the Nokia brand with co-branding and you have a strategic problem. Nokia’s other strength, in economies of scale, would also be lost through the increased costs associated with building and supporting shorter runs of US-specific machines.

As Rogers and Hammerstein would (almost) sing, "How do you solve a problem like America?"

Symbian, no, Android, no, WP7, blue, no, green, argh!

What to make of the phrase "Nokia must build, catalyse or join a competitive ecosystem" made by Elop in the Conference Call? It could simply be a statement of something that Nokia must do – the marriage of hardware, software and services is one of the key planks of how Nokia see the smartphone market. They have built (Ovi Store), catalysed (Ovi Maps) and joined (with the music labels in Ovi Music) - for example.

So why on earth would Nokia cede a third of their core strategy – services – to their biggest competitor – Google – and go with Android? There’s an argument going around that, given the US market is lost, they should just do it anyway, and this was a floating balloon to see the reaction. On paper they could go for a pure Android installation, forget about all the Google additions, and run with Ovi on the handset instead. But that’s a technical argument. Can you really see the shareholders and the board being happy with this? I can't.

Are there going to be tweaks to the platform strategy? Of course there will be. Is it going to be a handbrake turn into something radical? Quantum Theory says that in at least one universe that might happen, but I would be surprised if it was this universe.

We’ve still not fully seen what Stephen Elop wants

Even picking up the CEO reins in September, Elop would have been left with whatever choices Olli-Pekka Kallasvuo made during the end of 2009 and the first half of 2010. The Q4 2010 financial results being lower than hoped for is more because of the decisions made by OPK, decisions that may even have been spotted as risky during the summer and even led to his replacement by Elop. We’ve seen reports of some decisions by Elop in terms of marketing and alleged handset launches, but his big moment, to say "this is me, judge me on this", is not far away now.

The speculation around the Capital Markets Day event on Feb 11th is not helping

At least the media are going to represent it that way. With so much of Nokia’s recent communications tempered by “we’ll be announcing where we are going on February 11th” there is a worry that, no matter what they announce, it’s not going to be enough to sate the speculating journalists. Too many people are expecting too many things from it. An addition to, or switch in, the portfolio of OS platforms, the addition of a new ecosystem, moving the whole company to make racing car tyres(!), there are just too many people with ideas who are convinced they have the right idea.

I’m expecting that day to have a surprise or two. Watch this space.

-- Ewan Spence, Jan 2011.